Value in

motion

AI, climate change and geopolitical shifts are reconfiguring the global economy. We’ve mapped where value is moving over the next decade, so you can build a future-ready business to capture it.

1. Industry reconfiguration

Your growth plan just got

interesting

AI, climate change and other megatrends are changing the way we live and work.

Creating new customer needs. Forging new markets. Enabling new business models. Attracting new competitors. And blurring the boundaries of sectors and industries.

It’s time to look for growth in new places.

It’s time to explore new domains of growth — markets where companies work across sector boundaries to meet fundamental human needs. Like how we feed and care for ourselves, move, make and build things and how we fuel and power it all. Scroll on to understand how these domains will form and grow. And discover how to seize your share of the value in motion.

2. Domains of growth

Explore your new domains

Select from the nine domains below to learn how they are

forming, the size of the opportunity and how to seize the

value in motion.

Make

Explore your new domains

To meet the world’s need for materials and industrial goods, manufacturing must

reinvent itself through innovation, digitization and automation.

An epochal transformation of manufacturing is underway.

In the Fourth Industrial Revolution, manufacturers are a beacon of innovation — embracing the use of new technologies such as automation, 3D printing and Artificial Intelligence to boost their productivity, efficiency and agility. Companies are already using these advances to reinvent themselves. As a result of these efforts, up to $1.8 trillion of manufacturing revenues could be redistributed in 2035.

Other powerful catalysts include the need to insulate supply chains from climate shocks, the push to improve sustainability and circularity, the growing demand for workers with specialized skills and the impact of geopolitical tensions on trade routes. Together, they’re combining to forge a major sectoral reconfiguration in manufacturing.

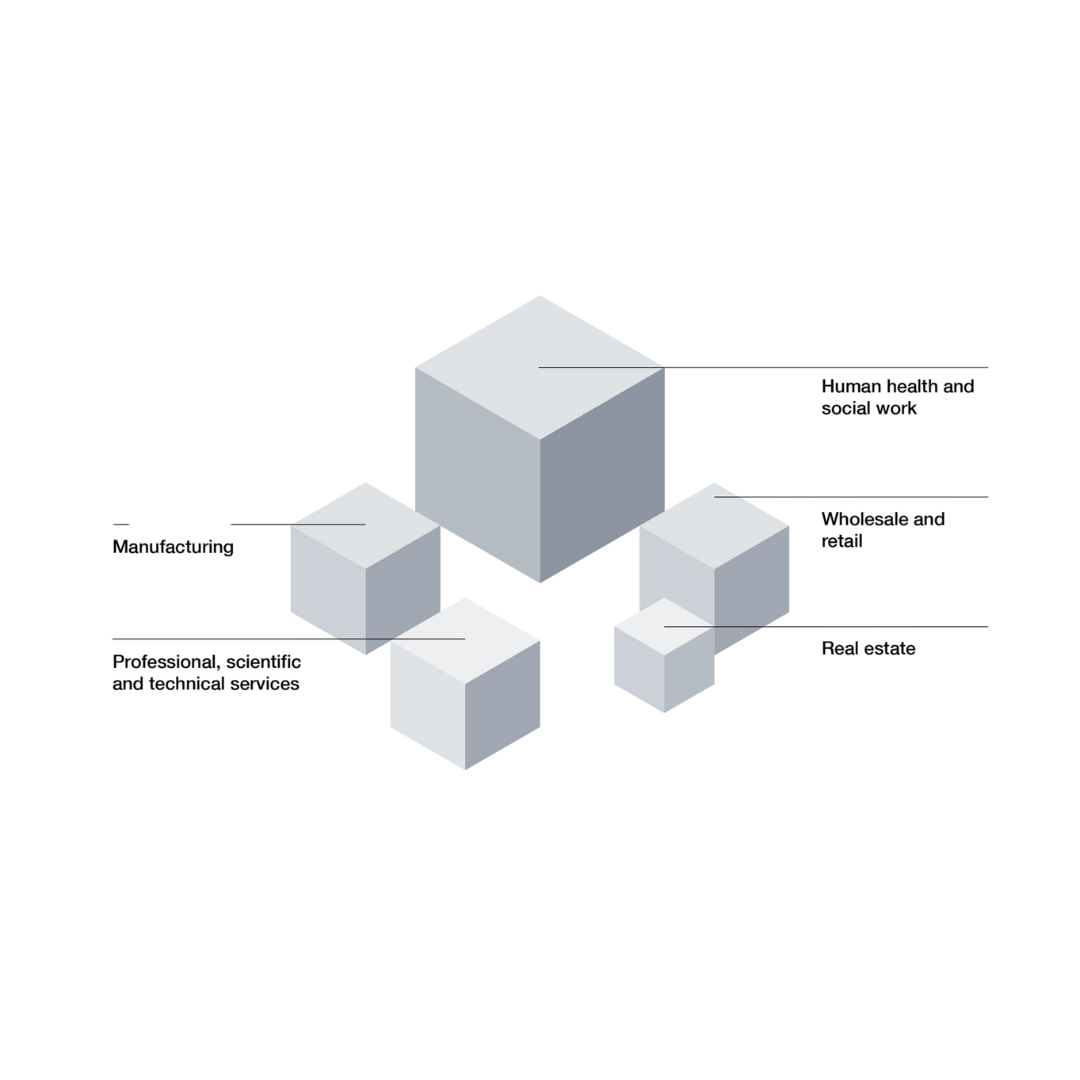

An expansive ecosystem is forming as companies reimagine what — and how — we make.

The Make domain will be a more diverse, tech-enabled zone in which firms integrate their capabilities and knowledge to create offerings that better meet customers’ increasingly complex needs. The new cast of players: classic manufacturers, along with IoT providers, AI firms, cybersecurity specialists and robotics companies.

Cross-sector collaboration has already helped companies develop elegant, multifaceted solutions. Aerospace companies boost aircraft and engine uptime by combining remote monitoring, predictive analytics, coordinated inventory management and automated maintenance scheduling. In other instances, customers pay for a function like energy generation, heating or filtration, while the company owns and manages the equipment, enhancing efficiency with the IoT and advanced analytics.

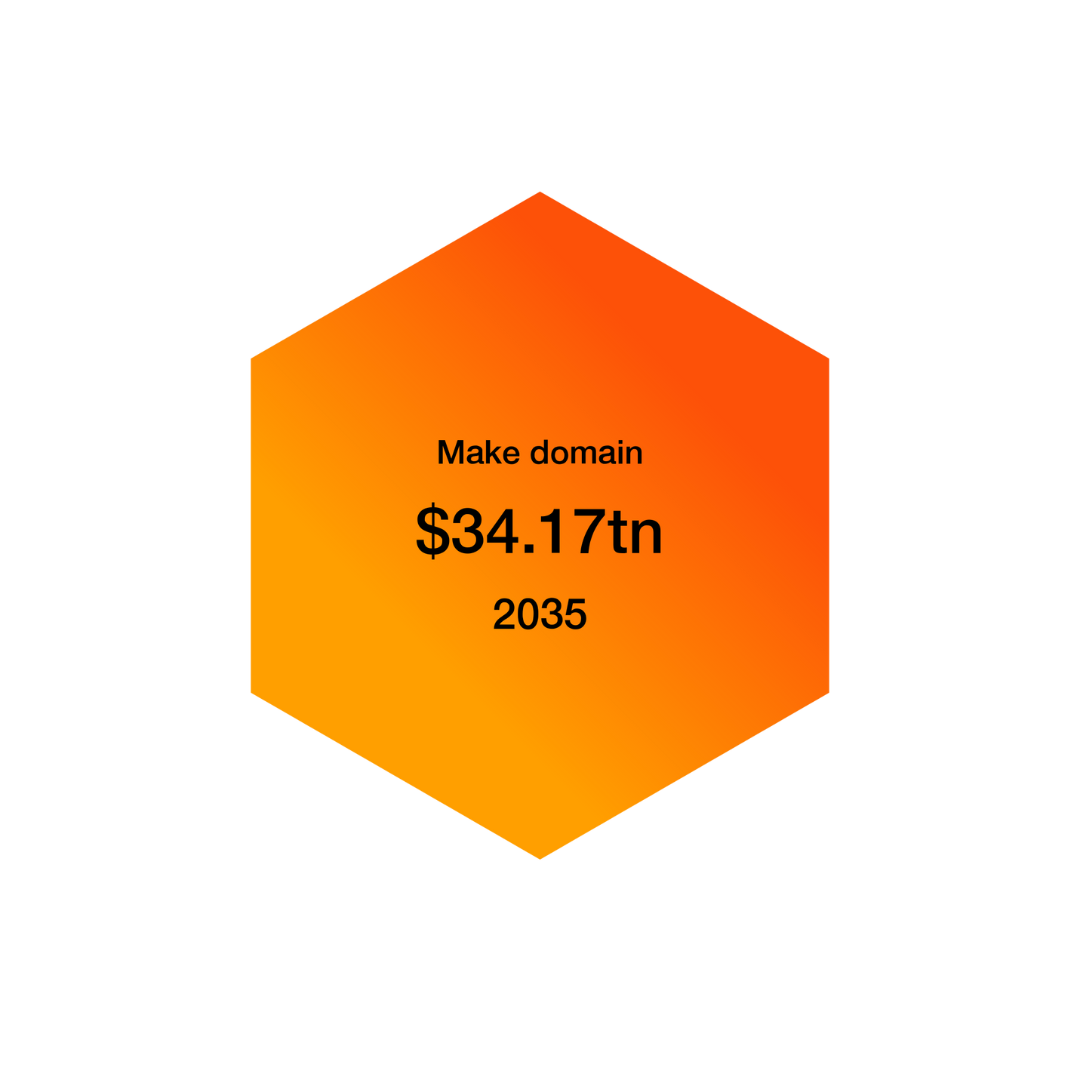

The burgeoning Make domain offers significant economic gains to decisive players.

Companies will find growth opportunities by looking across traditional sectors and recognizing distinct areas of customer need, such as raw materials, manufacturing data, climate solutions and materials science. By 2035, the Make domain could contribute $34.17 trillion to global GDP, representing about a quarter of total output.

The extent of that growth will depend on how megatrends play out.

To obtain a quantitative picture of what the Make domain might look like in 2035, we modeled the potential global economic impact of two of the most pressing megatrends: technological disruption (specifically disruption from AI) and climate change. The result is three divergent scenarios, corresponding to a range of outcomes, from a low of $33.91 trillion to a high of $36.84 trillion.

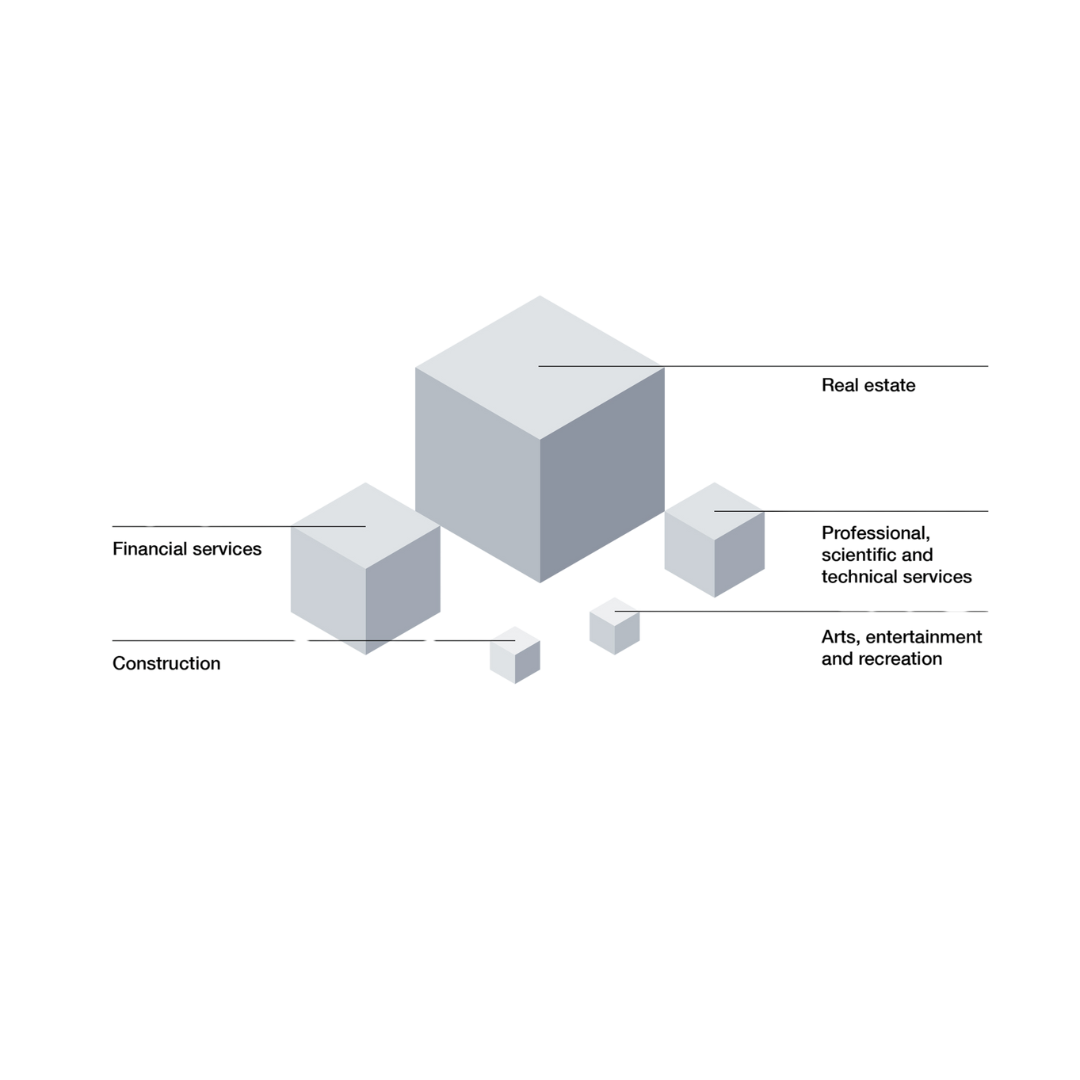

Build

How we build

Our need for places to live and work is growing — and changing. To meet it,

industries are converging on innovative ways to build.

Constructing the future means reimagining the way we build.

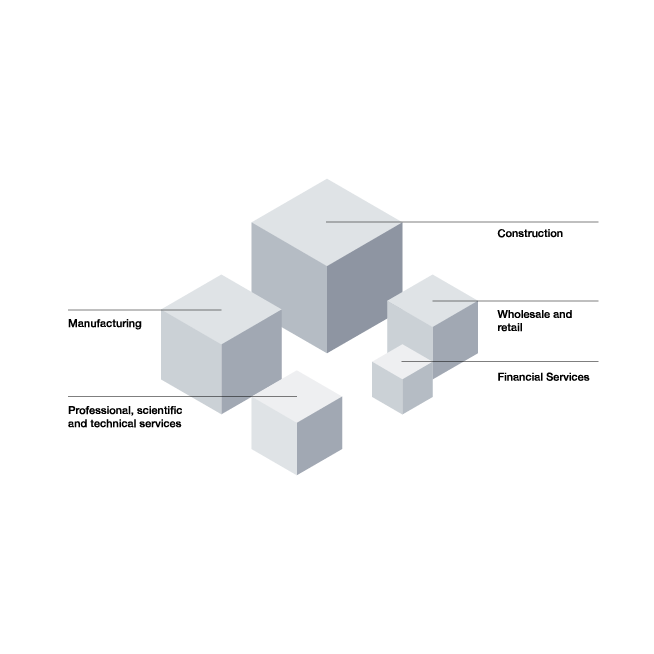

Until recently, the companies building the structures and cities where we live, work, meet and play have competed in discrete sectors: engineering, construction, manufacturing, finance and real estate.

But global megatrends are rapidly changing what people need from the built environment, and how those needs can be met. Climate change is intensifying demand for resilient, efficient homes, factories and airports. Urbanization is putting more pressure on housing and infrastructure. AI promises to lift architects’ and builders’ productivity.

Firms are responding with efforts to build more, and to do so faster and better than ever through alliances, collaborators and new ventures. This industry reconfiguration is giving rise to a domain of economic growth centered on how we build.

Firms can create value by working across sector boundaries.

Some real estate developers are using their strong balance sheets and financial savvy to establish venture capital funds that invest in sectors like property tech and energy efficiency.

Technology firms are competing with home appliance manufacturers by deploying smart devices and software that control home heating, cooling and lighting.

And some engineering companies are using their accumulated expertise and global relationships to expand into the management of wastewater systems, the detection of forever chemicals and the development of renewable energy plants.

In the construction sector alone, up to $517 billion of revenues could be redistributed in 2025 as firms reinvent their business models.

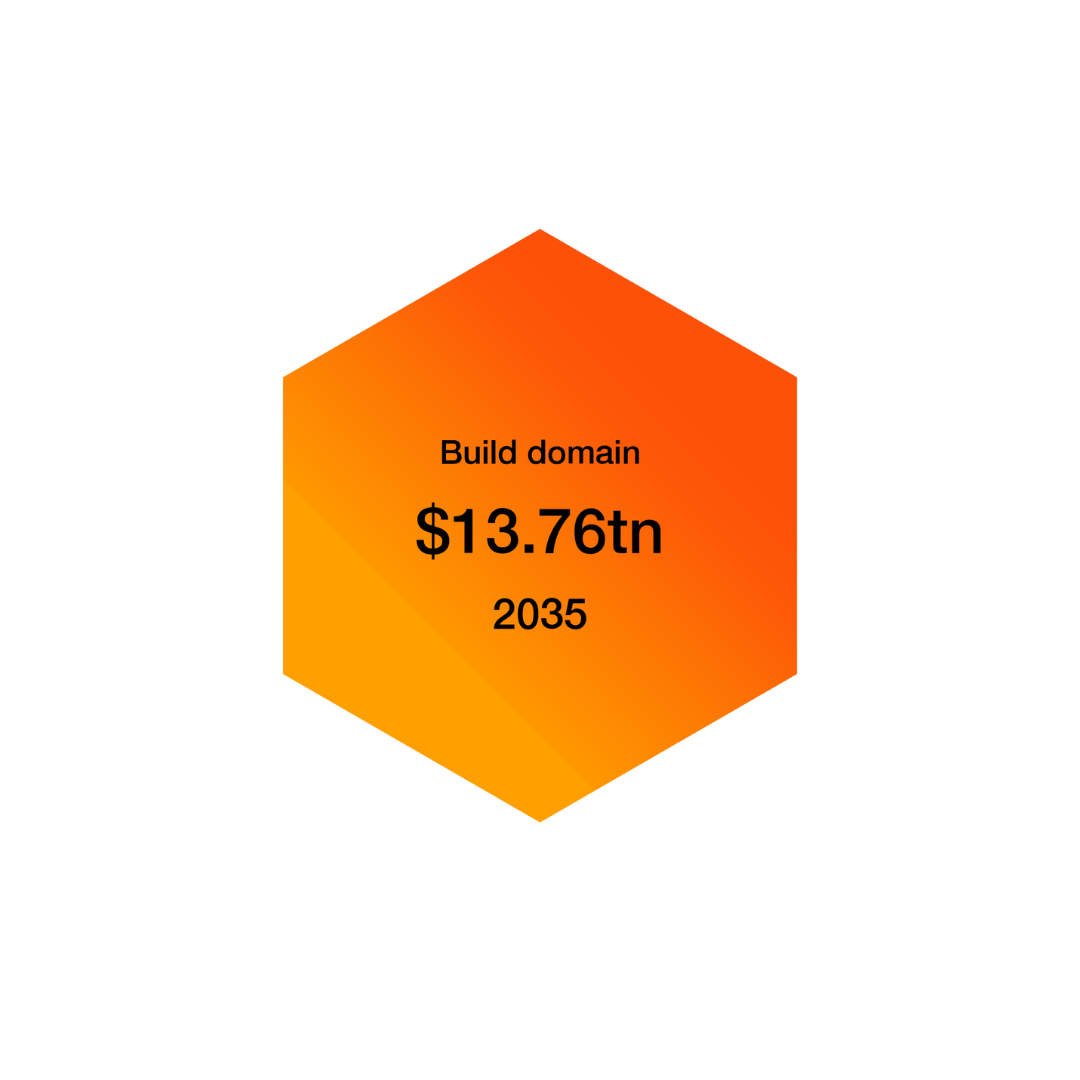

The value of the Build domain is projected to reach $13.76 trillion by 2035.

Much of that growth will come from the swift expansion of some nascent sources of value, such as prefabrication and modular construction, energy management and building-materials recycling.

The interplay of powerful factors will shape the trajectory of growth.

To help business leaders understand the possibilities for the coming decade, we modeled the domain’s growth under three divergent scenarios accounting for the impact of technological progress (specifically from AI) and climate action. Depending on the scenario, the domain’s size in 2035 could be as much as 3.0% above the baseline contribution of $13.76 trillion to global GDP or as little as 1.8% below it.

Feed

How we feed ourselves

The agri-food system is at a pivot point. Feeding 10 billion people at mid-century

will require a cross-sector push for innovation in the decade ahead.

The food system should be reconfigured to deliver abundance, resilience and sustainability.

Today’s food system is a complex global network: farmers produce, traders distribute, manufacturers process, retailers sell and the public sector supports and regulates to make food available daily. It’s also a system under pressure. Climate perils such as drought and heat stress threaten crops. The scarcity of water, arable land and other key resources is mounting. Food waste and loss eliminate one-third of what is produced for people to eat. All of these will be critical challenges as the global population nears 10 billion in 2050.

Some shifts toward a system that better supports well-being and growth are already underway: companies are ramping up efforts to reinvent their business models. In the accommodation and food services sector, we expect such efforts will cause $188 billion of revenue to move among companies in 2025.

Innovative, cross-sector relationships will redefine how we feed ourselves.

The answers to many of the challenges facing our food system will come from cooperative innovation. We should simultaneously scale technology, mechanization and sustainability in farming; reduce waste and make processing more efficient; and adapt to healthier, eco-conscious diets. Above all, we’ll need to mitigate the impacts of climate and weather volatility on the food supply.

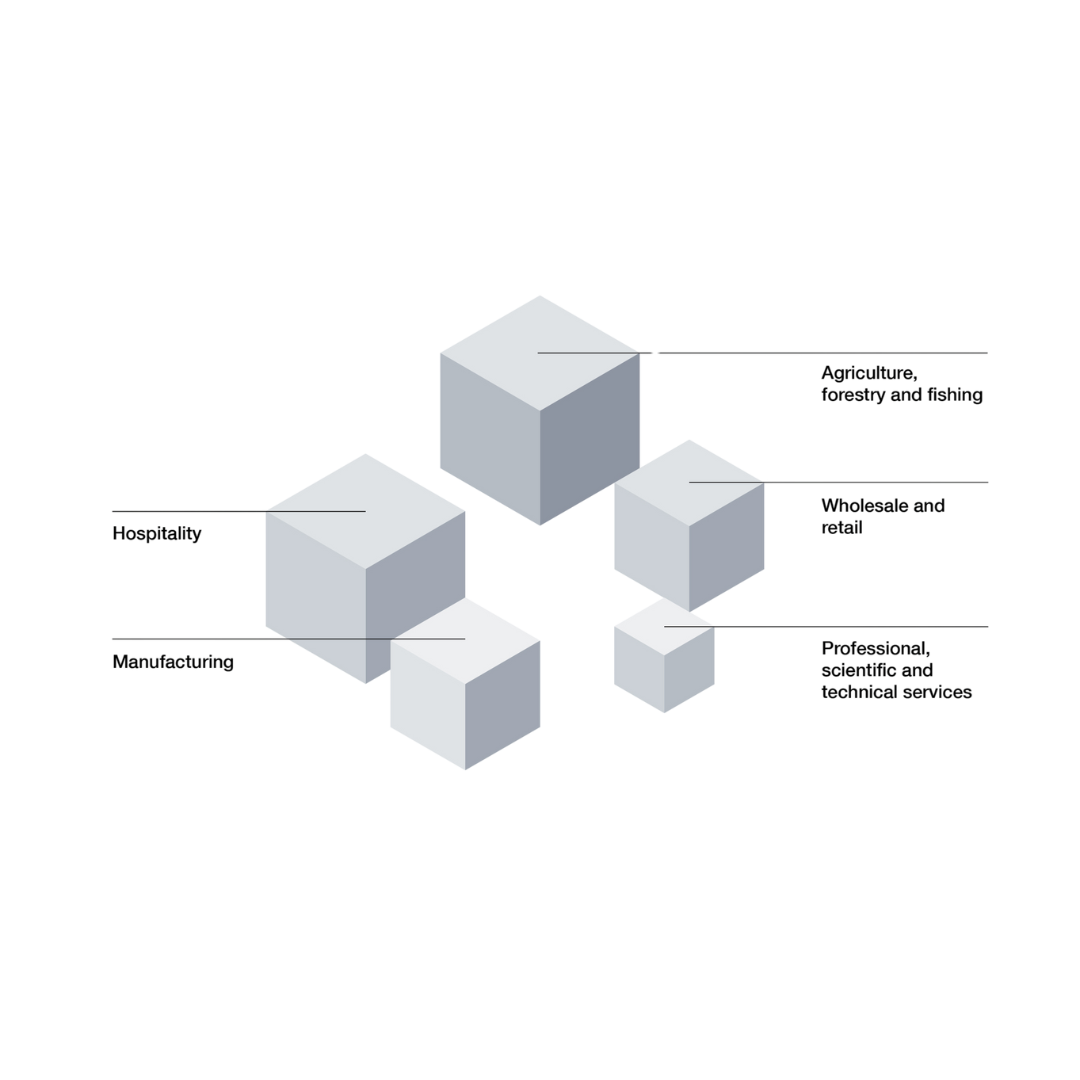

As companies redesign the way food is produced, processed and consumed, they will form strategic relationships that span existing sectors: farmers and agricultural firms, wholesalers and transport organizations, equipment makers and tech players, processors and retailers, research labs and financial institutions. The resulting mix of activities will make up a unified, growing domain centered on how we feed ourselves.

The expanding Feed domain will create opportunities for resourceful businesses to grow.

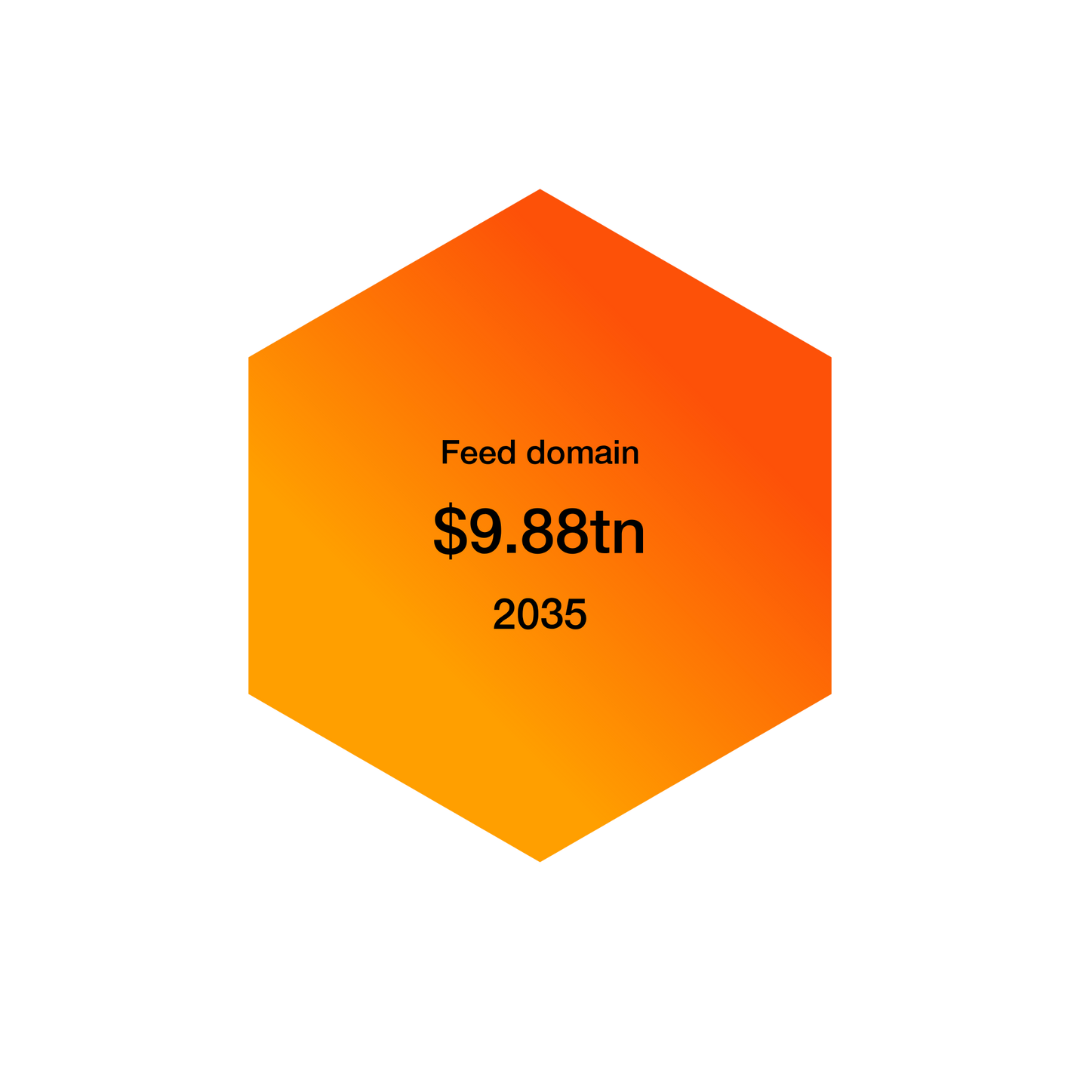

Amid the transition, exciting prospects are emerging around farming, food processing, urban agriculture, data and logistics. Innovations such as AI-driven crop monitoring and precision farming could revolutionize how food is grown, and initiatives aimed at cutting food waste — estimated to cost the global economy $1 trillion annually — open new avenues for improving efficiency and environmental impact. We project that in 10 years, the evolving Feed domain could contribute $9.88 trillion to global GDP.

Leaders should prepare for a broad range of possible conditions.

Which areas of the Feed domain generate the most value will depend in part on how global megatrends unfold. To explore the possibilities, we modeled the potential economic impact of two of the most pressing megatrends: technological disruption (specifically from AI) and climate action. This analysis, performed under three discrete scenarios, points to a range of potential sizes for the Feed domain. The lowest projected GDP contribution, $9.85 trillion, is only slightly off the baseline, while the highest reaches $10.83 trillion.

Care

How we care

As the world confronts medical challenges, the healthcare sector can provide care at

scale that is effective, affordable, preventative and personalized.

A value-rich domain is forming centered on caring for humans.

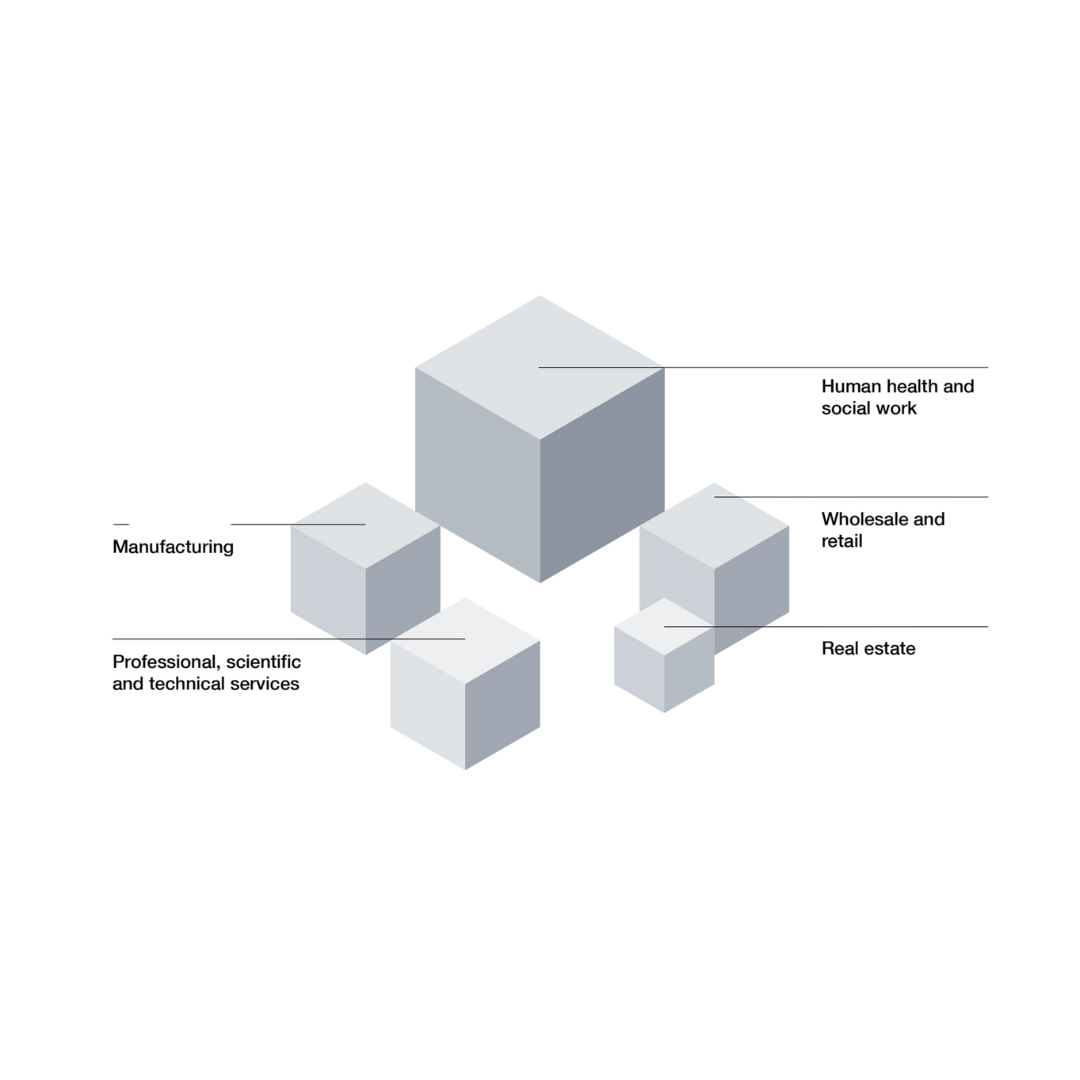

Historically, healthcare organizations — hospitals, clinics, life sciences companies and insurance providers — operated in distinct fields. But global megatrends, including AI and climate change, are rapidly reshaping what people require from healthcare systems and how these needs can be met. At the same time, science and technology are expanding possibilities.

As aging populations pressure healthcare services and infrastructure, rising costs of managing chronic diseases are increasing demand for personalized, preventative care. Digital technologies, particularly AI, promise to enhance the efficiency and effectiveness of medical practices by providing advanced diagnostic tools, predictive analytics and virtual care. With companies already embracing such efforts, up to $216 billion of healthcare revenues could be redistributed in 2025.

The Care domain presents opportunities to work across sector boundaries.

Some traditional healthcare organizations are leveraging their expertise and resources to work with healthtech start-ups or are developing digital platforms to enhance patient engagement and care coordination. Firms from outside the healthcare industry are extending their core capabilities to challenge incumbents — think of tech companies creating wearable devices and applications for remote health monitoring and telemedicine or chipmakers working with healthcare providers to produce more effective analysis of pathology.

Companies that have long specialized in pharmaceuticals or medical equipment might use their specialized knowledge to develop personalized integrated health solutions that encompass diagnostics, treatment and follow-up care. These transformations highlight a shift toward a more holistic and efficient approach to healthcare delivery.

The evolving Care domain will be a platform for new modes of value creation.

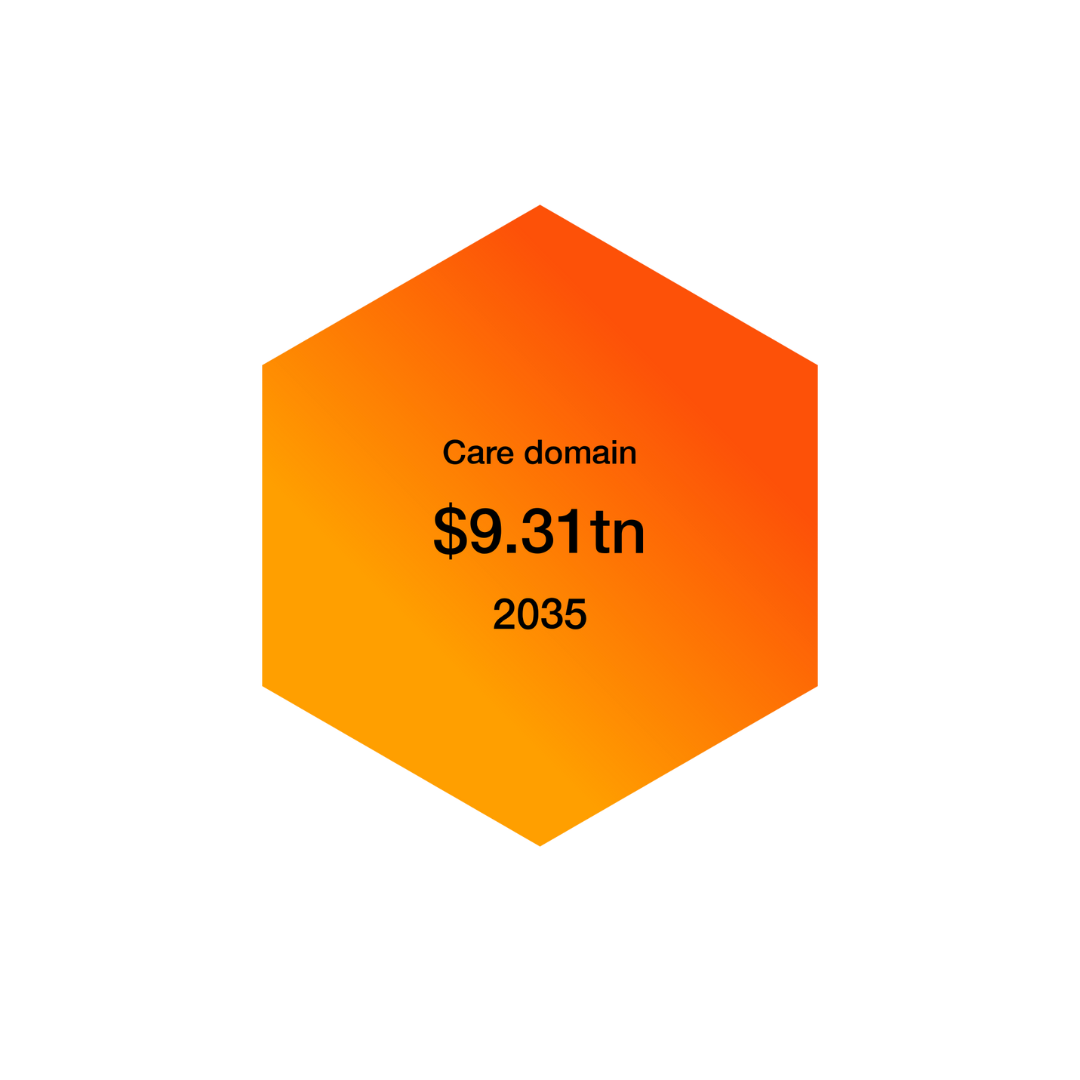

Large and familiar value pools — such as health insurance and medical data — will grow and evolve significantly, and more nascent sectors, like personalized medicine and B2B-focused medtech, will gain momentum. By 2035, the Care domain could grow to contribute $9.31 trillion to global GDP — 7% of total output.

Megatrends and geopolitical change will dictate the trajectory of growth.

To help business leaders grasp the potential for the next decade, we modeled the Care domain’s growth under three divergent scenarios focusing on technological disruption, particularly from AI, and climate change. Depending on the scenario, the size of the domain in 2035 will range between a low of $9.38 trillion and a high of $10.56 trillion.

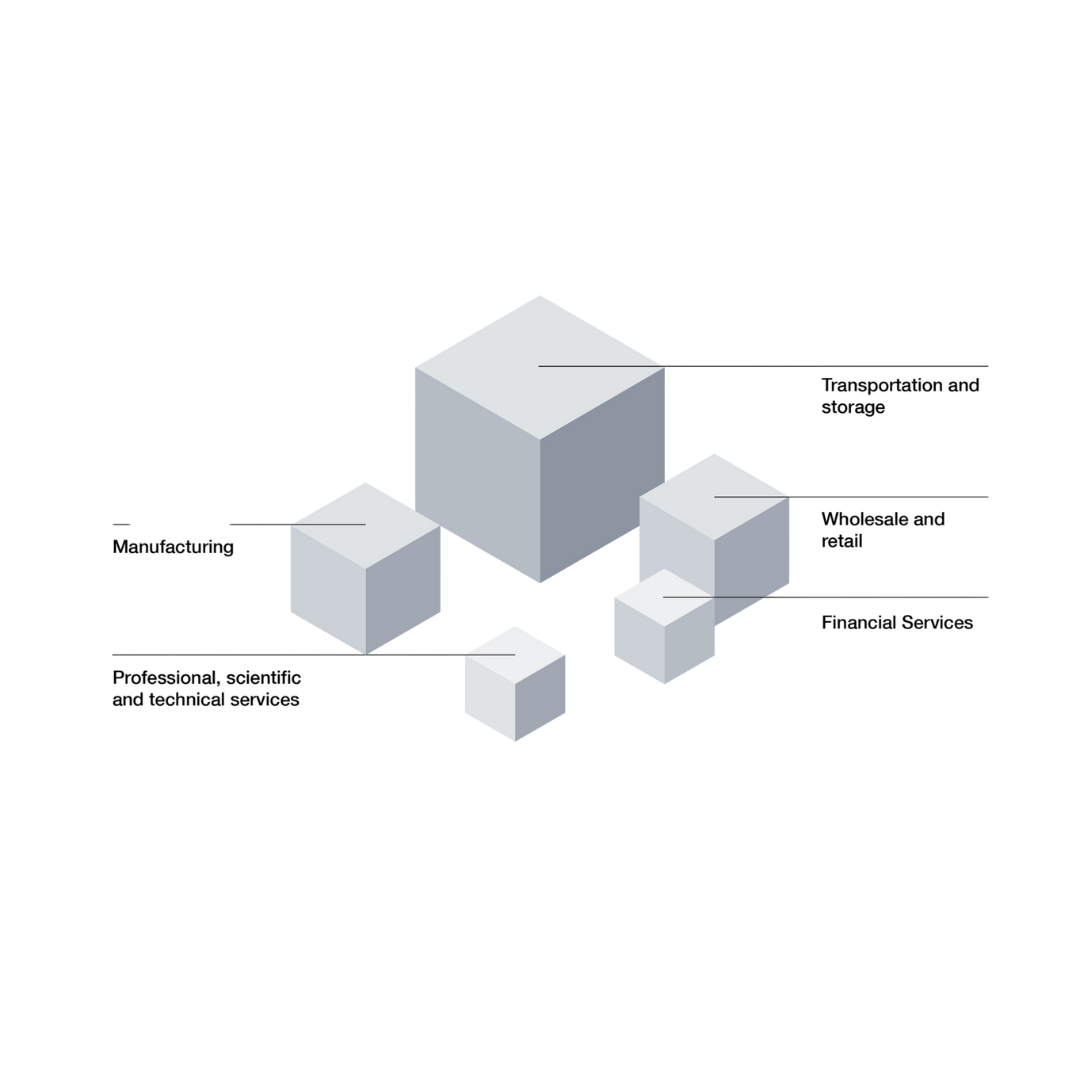

Move

How we move

To meet customers’ needs for safe, efficient, affordable transportation, mobility

players are tapping into clean tech and digital solutions.

Megatrends are forming a clean, connected domain around how we move.

The way we move goods and people around cities, nations and the planet depends on enterprises in many sectors. Consider the array of businesses involved in supplying cars: mining companies, parts makers, auto original equipment manufacturers (OEMs), logistics companies, banks. Although these enterprises work together, they largely specialize in segments of the automotive value chain.

Now, megatrends like AI adoption and climate change are pushing companies that serve road, rail, air and sea transport to redevelop their value chains. Non-industry players, like tech companies, await them as potential competitors — or collaborators — in this new world. As these efforts fundamentally reconfigure traditional sectors, a domain of growth is forming around how people and goods move.

Players in this domain will combine tech and skills in novel ways.

Collaboration across sectors will result in creative new answers to mobility needs. Consider electrification: the shift to electric powertrains is accelerating as an extensive ecosystem of companies working together to ramp up mineral supplies, battery production and charging infrastructure. Looking ahead, legacy players, such as OEMs and component manufacturers, will team up with newer participants like payment-system providers and energy services firms. For companies, success will depend in part on how well they manage relationships with diverse partners.

All this change is putting significant value into motion. Pagovision analysis suggests that in the transportation sector, some $425 billion of revenues could be redistributed among companies in 2025 as they reinvent their business models.

As mobility needs evolve, more sources of business value will emerge.

Further growth opportunities can develop as megatrends alter existing mobility preferences and create new ones. Rising demand for autonomous vehicles (AVs) — robotaxis and robotrucks, drones and even industrial machines like forklifts — will open all sorts of value-creation pathways for manufacturers, telecom players, infrastructure providers and other entities. A transition to circular business models in domains such as Make or Build would require new logistics solutions.

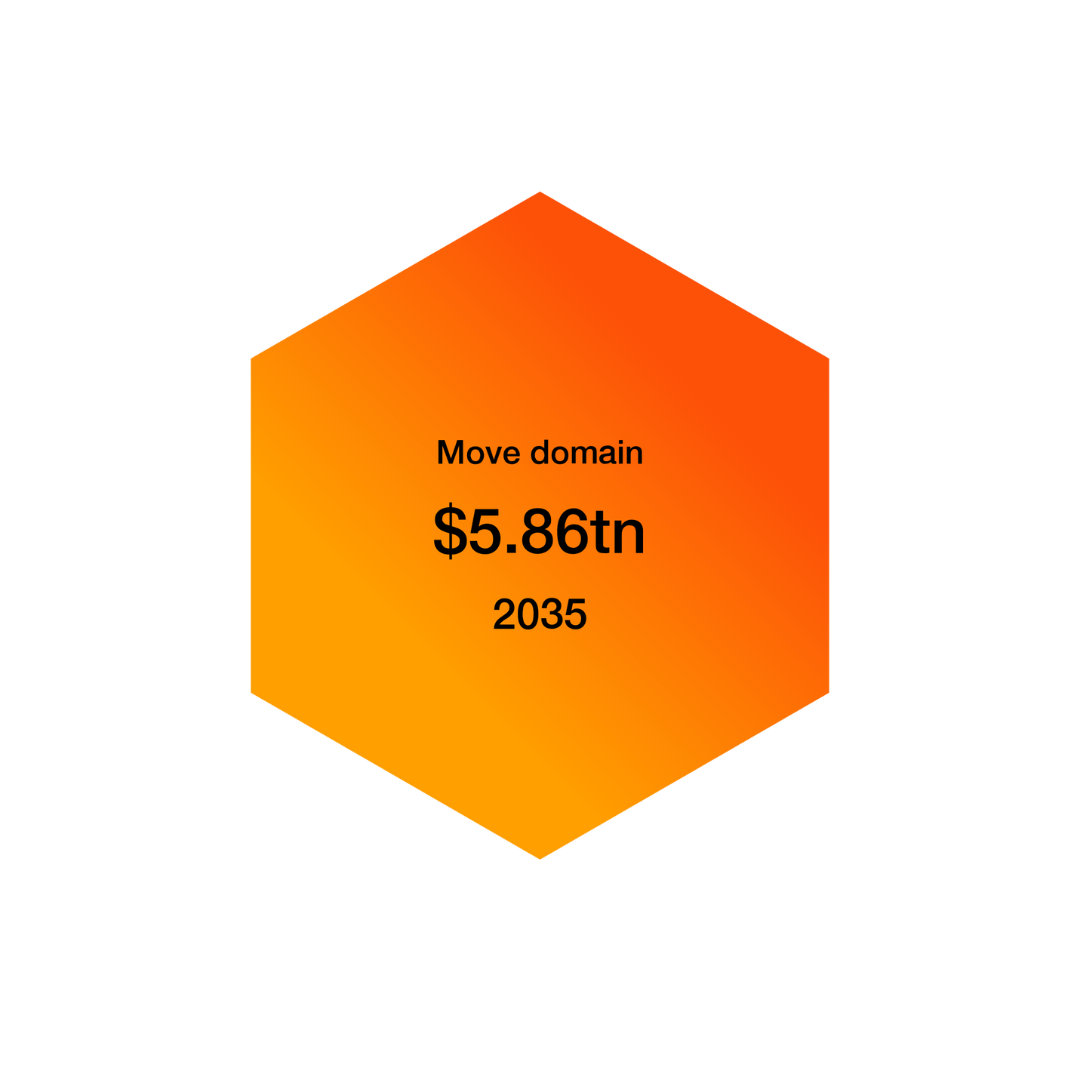

The range of activities and businesses involved in the Move domain extends well beyond the scope of any single industry. In a baseline scenario for economic growth, we project that the Move domain will contribute $5.86 trillion to global GDP in 2035.

The domain’s growth depends on how megatrends unfold.

Global megatrends will have a powerful influence on what the Move domain looks like in 2035 — but the nature of that influence is difficult to predict.

To help business leaders appreciate the range of potential outcomes, we modeled the economic impact of technological disruption from AI and from climate change under three divergent scenarios. The result is an outlook in which the size of the Move domain ranges from $5.83 trillion to $6.41 trillion, and business growth opportunities vary considerably.

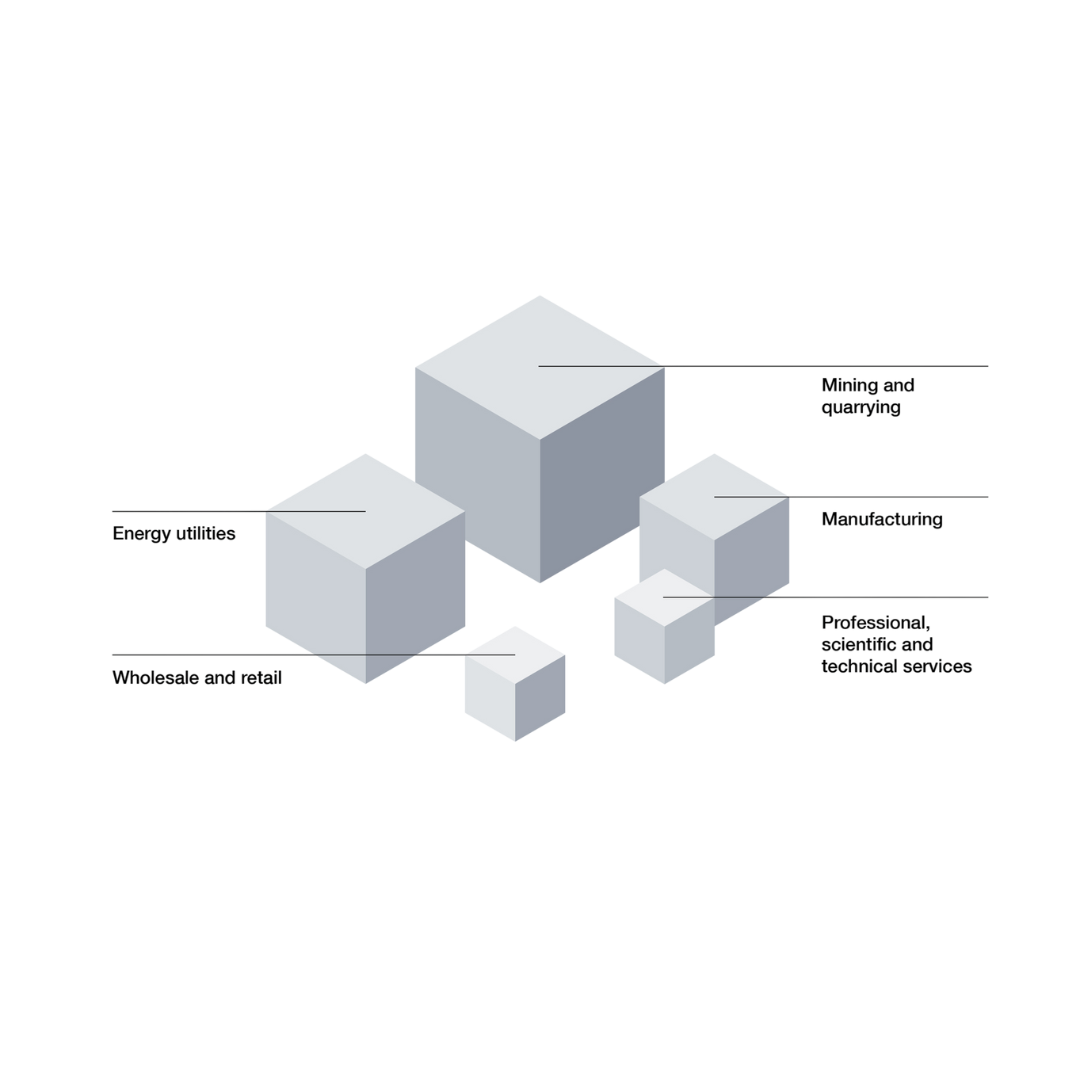

Fuel and Power

How we fuel and power

To provide clean and reliable access for a rising population and enable industries to

meet demand, the energy sector should embrace new ways of operating.

The industries that enable global progress are transforming.

The long-established value chains that transform fossil fuels into electrons and molecules that fuel our world still define the global energy industry. But the system is rapidly evolving as climate change forces a fundamental rethink — and technological innovations create new opportunities.

As it shifts to incorporate more zero-carbon electricity and new low- and no-carbon fuels, the energy system should enable reliable access to energy for a growing global population, and low-cost power sources to enable industries to meet rising living standards.

Critical sectors such as steel, chemicals, fertilizer and plastics drive demand for fossil fuels. Investment is climbing in companies working on alternative fuels, power storage, transmission infrastructure and new technology, such as AI and analytics, that can identify and drive efficiency.

Companies will harness new technologies and integrate a mix of sources.

A rich blend of established players and new entrants will collaborate and compete to solve the challenge of decarbonizing at scale by developing offerings designed to meet an increasingly wide, complex set of customer needs.

Transport and homes will increasingly be powered by electricity, providing a boost to energy storage and low-carbon generation. Electrons, some stored in the shape of molecules like hydrogen, will also play an important role in industry — displacing traditional molecules.

While fossil fuels, which currently provide 80% of global primary energy demand, continue to play a vital role, working on lower-carbon solutions like energy efficiency, carbon capture and the application of AI to emissions reductions efforts will offer opportunities for value creation.

The value of the Fuel and Power domain is projected to reach $6.19 trillion by 2035.

As supply and demand for vital resources grow, value will be created in fundamentally different ways. AI, which will increase electricity demand, can be deployed to help manage grids, drive efficiency and lower costs simultaneously. Other modes of value creation that are nascent today, such as sustainable fuels and green hydrogen, will need to scale dramatically.

The path of growth will depend on how megatrends play out.

To paint a quantitative picture of the future, we modeled the Fuel and Power domain’s growth under three divergent scenarios, focusing in particular on the impact of technological disruption, specifically from AI, and climate change. Depending on the assumptions, the size of the domain in 2035 could range from a low of $6.03 trillion to a high of $6.46 trillion.

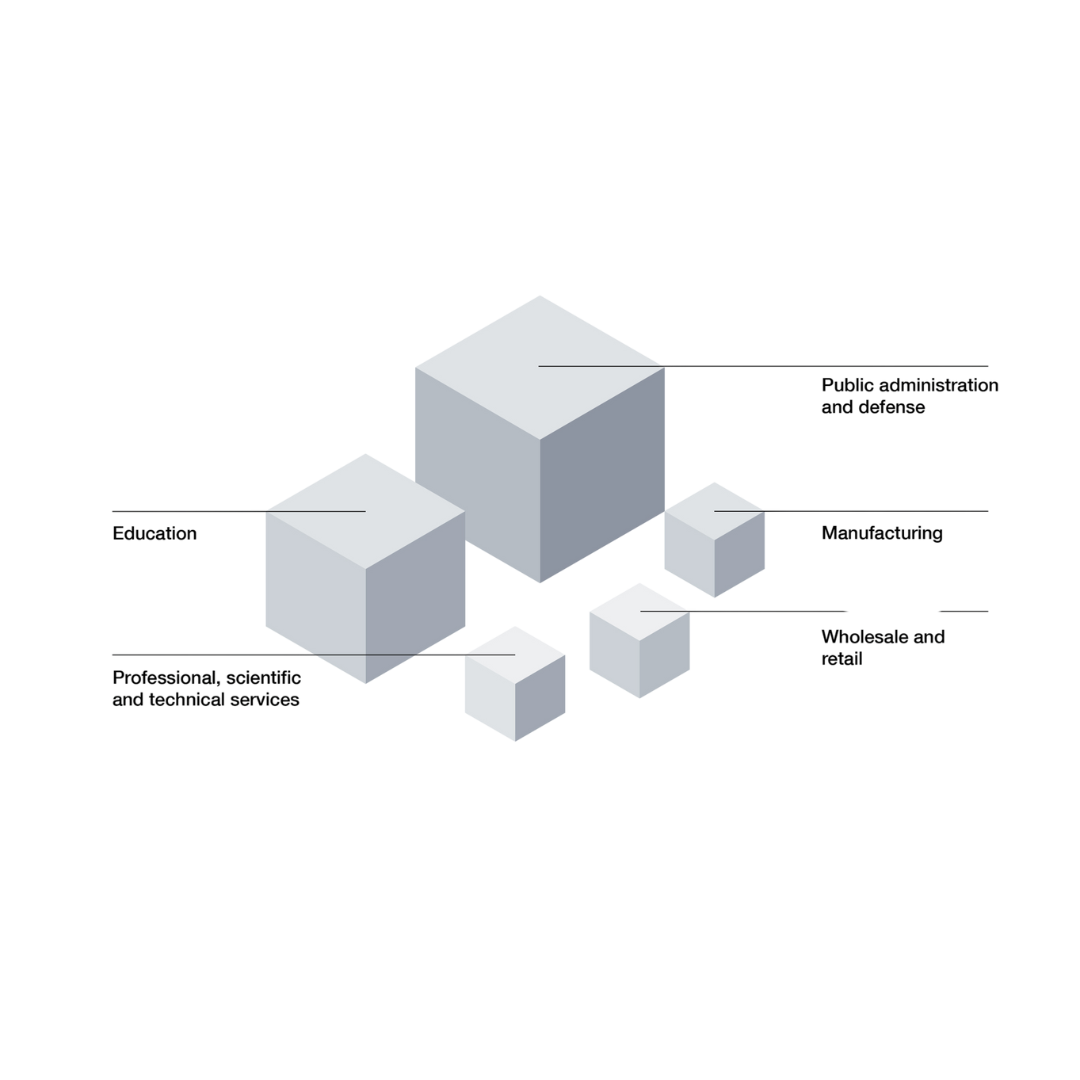

Govern and Serve

How we govern and serve

By supporting collaboration between sectors, governments can help improve well-

being and advance prosperity.

Governments must evolve to serve people’s changing needs.

As climate change and other megatrends alter human needs, businesses and governments are working together in new ways to improve people’s lives.

Consider how mounting weather disasters and demographic shifts are stoking demand for affordable, resilient housing. Construction companies are creating solutions through innovative collaborations with manufacturers to fabricate cost-effective modular structures and with energy firms to install onsite renewables. And governments are igniting even more innovation by supporting materials research, updating energy codes and investing in infrastructure.

This bold, catalyzing role can help governments foster citizens’ well-being in an era defined by cross-sector collaboration.

The Govern and Serve domain enables activity in every other domain.

As sectors reconfigure, it’s helpful to think of governments and public institutions as belonging to a broad Govern and Serve domain, one that enables the fulfillment of human needs through its own actions and through interactions with other domains. For example, by installing the IoT-networking infrastructure needed for smart-city systems, the Govern and Serve domain can foster new opportunities in the Build and Move domains. In the Make domain, public-sector procurement could hasten the development of sustainable materials. In the Care domain, the public sector could partner with medtech companies to develop AI-driven health diagnostics. Governments can also spur cross-domain collaboration on issues such as workforce upskilling.

Powerful megatrends pose new questions for the Govern and Serve domain.

The megatrends driving industry reconfiguration also influence the government — introducing new policy considerations and transforming the ways in which public institutions function. For example, AI can affect citizens’ security in ways that might move governments to consider protective measures. At the same time, AI can serve as a powerful tool for public-sector transformation. When governments establish policies for safe, effective AI use, they help build trust in the technology. Then they can deploy it to boost productivity and better meet citizens’ expectations for accessible and effective service. The growth of the AI sector is also giving rise to new public–private relationships, like those intended to build out energy and digital infrastructure.

Leaders should prepare for a variety of potential futures.

The activities of governments and the public sector — considered alone, together and in conjunction with private industry — generate considerable value for the global economy. In our baseline projections for growth, the Govern and Serve domain could contribute $17.42 trillion to global GDP in 2035. But that contribution could also be 11.0% higher, rising to $19.33 trillion, depending on how the two most pressing global megatrends, technological disruption and climate change, shape the need and context for government services.

Fund and Insure

How we fund and insure

Capital is a vital catalyst for growth. How it’s deployed, managed and insured

should evolve along with the industries it serves.

As industries change, so do the opportunities for companies that finance them.

Change is afoot. Industries are reorganizing around human needs — to get around, to build spaces for living and working, to care for our health. Established businesses and new ventures alike are creating value in innovative ways; they’re working across sector boundaries to combine diverse ideas and capabilities into offerings for the growing needs-centered domains of the economy.

This flurry of industry reconfiguration is providing new opportunities for the financial economy, too. As a critical enabler of other domains, the Fund and Insure domain is fertile ground for cross-sector collaboration among non-traditional vendors, providing them with new, more efficient models for capital allocation and financial services. Inventing such models means rethinking not only how and where capital is deployed, but who deploys it — and conceiving of capital allocation as a domain of growth unto itself.

Financial firms can reinvent themselves within the shifting economic landscape.

As companies evolve within domains, institutions in capital markets, as well as private equity and principal investors, stand to gain by applying novel approaches to risk, valuation and portfolio management. Winning companies will reimagine their roles as allocators of capital, much as traditional banks did a decade ago, when insurers, asset managers, tech giants and others began offering private credit. The redistribution of market share in financial services will be significant: we estimate that $604 billion could change hands in 2025 as a result of reinvention moves by companies in the banking and capital markets, insurance and asset and wealth management sectors.

As domains expand, businesses can create additional value within Fund and Insure.

Over the next 10 years, companies will carry on reinventing business models and forming strategic relationships to participate in the emerging domains of growth. Their moves will have critical implications for the financial institutions that support them, creating new prospects for businesses involved in capital allocation.

Those prospects are likely to draw in players from non-financial companies as well. With trillions of dollars of excess capital on their balance sheets, non-financial companies are well-positioned to develop and deliver alternative offerings within the Fund and Insure domain.

Leaders should be prepared to capitalize on disruptions.

Megatrends such as climate change and technological disruption will shape the extent and nature of industry reconfiguration in the years ahead. And those trends could play out in a number of ways. There’s a wide range of possibilities for what capital and financial services might be required — farmers, retailers, manufacturers, construction companies and others will all have their own needs — and for the asset classes and risk profiles of the businesses that capital providers might back.

To help business leaders envision the possibilities, we modeled the Fund and Insure domain’s growth through 2035, while accounting for climate and tech disruptions. The result is a range of three potential scenarios, spanning a low of 1.3% below baseline and a high of 12.4% above.

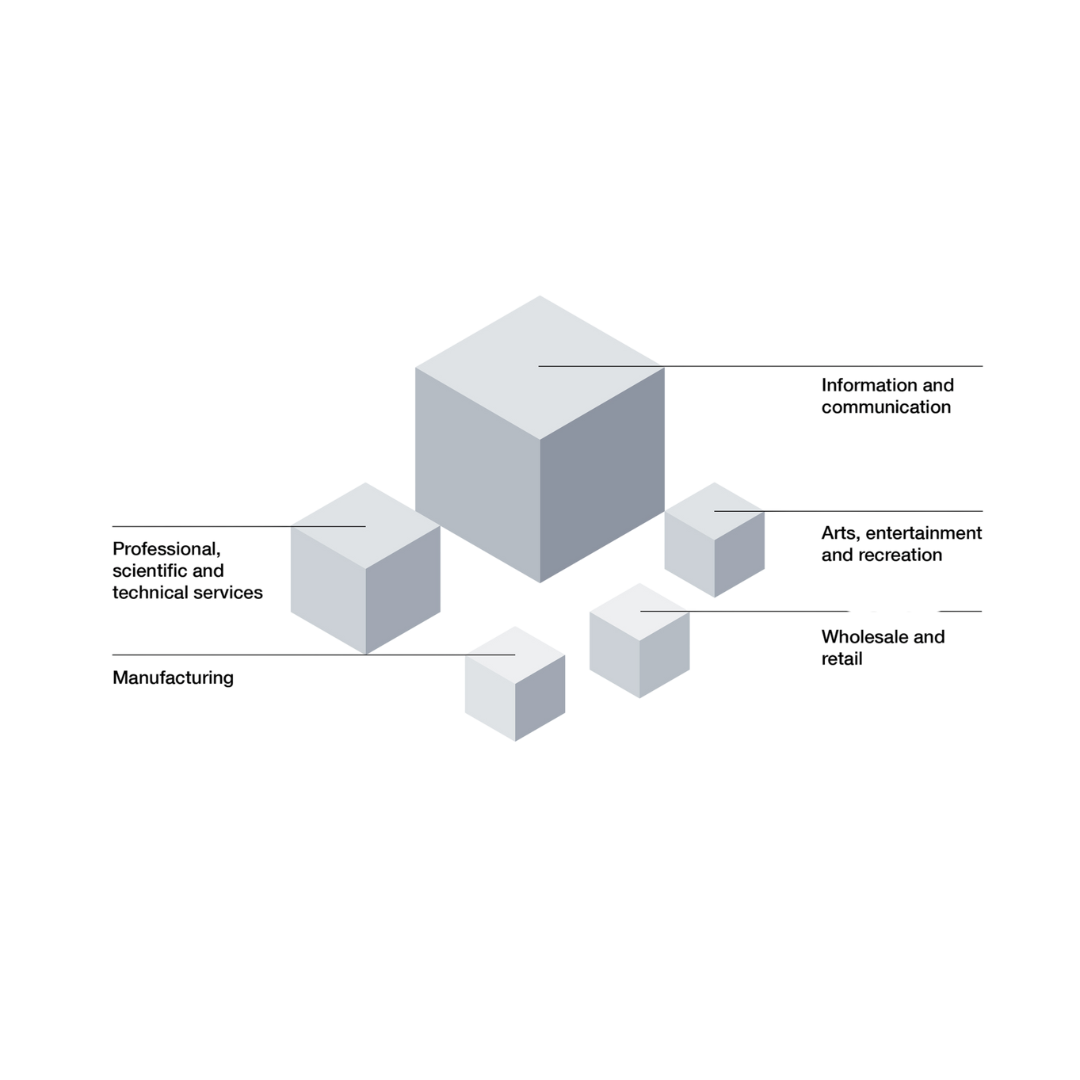

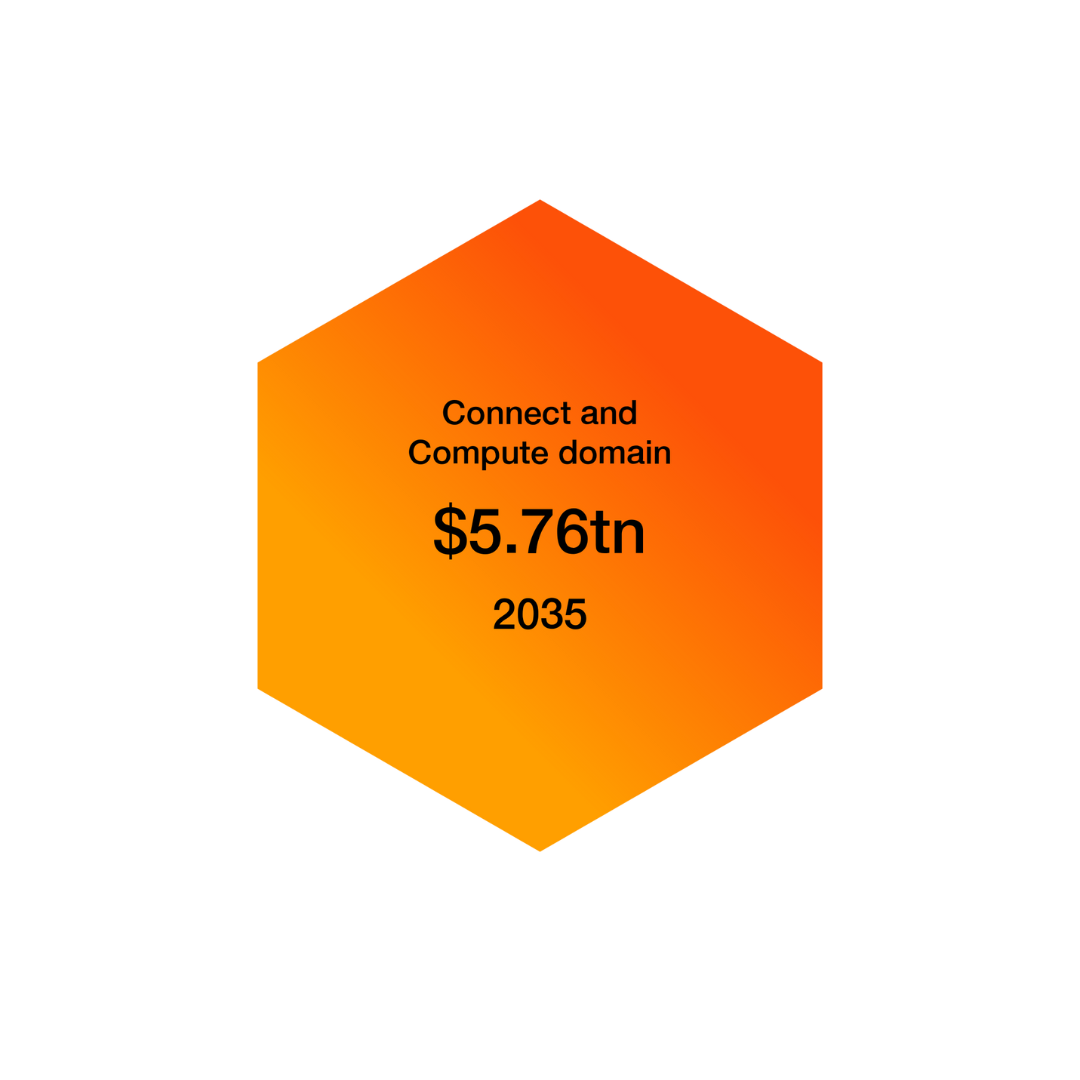

Connect &Compute

How we connect and compute

Business collaboration increasingly runs on technology. And the businesses

developing that technology must increasingly collaborate to thrive.

More than any other megatrend, technological disruption drives cross-sector collaboration.

Industry 4.0. Precision agriculture. Autonomous vehicles. Algorithmic drug discovery. These are just some of the innovations that companies have developed by layering massive computing power and widespread connectivity into their business models to access fresh sources of value. What’s striking about these innovations is their combinatorial nature. Businesses are bringing together technologies, from semiconductors to satellites, with concepts from different industries to create seamless customer offerings. In this way, advances in tech not only spur collaboration and invention, they also catalyze the formation of economic domains centered on humanity’s changing needs. And as generative AI makes it ever easier for people to extract useful insights from messy stores of data and bring new ideas to life, the pace of co-creation is bound to pick up.

The work of connecting and computing defines a vast domain of growth.

Although tech and telecom businesses will often lead the way in the emerging Connect and Compute domain, rich opportunities await companies from other sectors too. Governments will invest in AI infrastructure, fund research and STEM education and craft policies for responsible tech usage. Energy and battery companies will supply power for everything from tiny Bluetooth beacons to sprawling 5G networks. Manufacturers will produce tech devices and equipment. And many companies from outside the tech sector will commercialize their homegrown software and tech solutions. Financial institutions famously employ programming wizards to help them manage risk and beat the market — and some are turning their proprietary code into products they can sell.

In the Connect and Compute domain, businesses converge to meet tech needs.

The diverse organizations operating within the Connect and Compute domain will create greater value through intensive collaboration with companies across domains. We already see this happening. Big tech platform providers are joining with investors, governments, energy companies and construction firms to set up powerful data centers that will extend AI capabilities to all segments of the economy. Semiconductor suppliers are going beyond provisioning chips by working with customers in Care, Make and other domains to co-develop software and algorithms for industry-specific purposes.

Leaders in the Connect and Compute domain should prepare for a range of possible futures.

The reconfiguration of industries presents the Connect and Compute domain with nearly endless opportunities. They could spark the next wave of growth telcos have been seeking and expand a tech market already projected to grow. However, megatrends will greatly influence how much this domain adds to the global economy.We explored three potential ways that the most pressing of these trends — climate change and technological disruption — could unfold over the next 10 years. Our modeling shows they could push the Connect and Compute domain’s contribution to global GDP as much as 9.5% higher or 0.5% lower than the baseline scenario by 2035.

3. The opportunity

Capturing the value in the decade ahead

Businesses that grasp the full potential of the Make domain will have the edge in 2035.

Sizing the Make opportunity

The nature and scale of the new business opportunities that emerge in the Make domain will depend on how AI adoption and climate action progress. Your strategy should account for a range of possible outcomes.

Three scenarios can help leaders in the Make domain consider what the future might bring.

In Trust-Based Transformation, a coordinated, conscientious approach to tech deployment and climate response fosters productivity growth, job creation and environmental health.

In Tense Transition, regionalization and nationalism give rise to technology systems and sustainability efforts that deliver benefits without the economies of global scale.

In Turbulent Times, atomized interests, divisive uses of technology and suspended sustainability initiatives hamper economic growth.

Global baseline 2035

$34.17tn

Trust-Based Transformation $36.84tn

Trust-Based Transformation

Global alignment

Responsible tech

Sustainable solutions

Demand for goods and equipment that cause minimal harm to the environment — along with strict environmental regulations — encourages businesses to embrace sustainable sourcing and production practices. Waste reduction and resource circularity become governing concepts for successful manufacturing firms. Technology firms develop AI and data-security tools to promote transparency and efficiency along value chains.

Who succeeds?

A materials science company bioengineers an environmentally safe, waste-free method for producing high-performance industrial fibres by cultivating genetically modified yeast in tanks. The complex production process is streamlined by AI and a secure Internet of Things (IoT) device network, with output informed by digital forecasting tools and an integrated inventory-management platform.

Tense Transition $35.36tn

Tense Transition

Regional alignment

Fragmented tech

Subscale sustainability

Conflicts over land use, resources and migration lead to political and economic fragmentation along regional lines. Companies prioritize smaller-scale, local manufacturing and shorten supply chains to achieve operational resilience and conform to the particular standards of each region. They also seek efficiency gains and resource security through reuse and recycling, contributing to an active market for after-life goods and materials.

Who succeeds?

A business specializing in the reclamation and recycling of corrosion-resistant composite materials develops a cloud-based subscription platform. The new platform enables aerospace firms, flooring companies and marine manufacturers to easily sign up for offtake services and thereby reduce disposal costs. Revenue — and a reliable stream of raw materials — from a growing subscription base prompts the recycling company to pilot a new business producing modular building components from reclaimed composites.

Turbulent Times

Atomized interests

Disruptive and divisive tech

Suspended sustainability

Poor resource management causes intense geopolitical conflicts over raw materials, leading to disruptions in global supply chains. Companies localize their procurement of raw materials and invest in developing alternative materials. Meanwhile, with few incentives to buy reusable or recyclable goods, consumers increasingly value convenience and speed over sustainability. Companies respond by prioritizing low-cost production.

Who succeeds?

By subscribing to a robotics-as-a-service platform and using AI-assisted anomaly detection on the factory floor — and by shifting to regionally procured plastics and components — a medium-sized appliance manufacturer shortens its production cycle and reduces costs. The changes enable it to introduce a line of refrigerators at a radically lower price than those of its competitors.

Six more future-ready business ideas

These quick-hit concepts — some of them suited for just one future scenario, others for more — offer additional inspiration for business model innovation.

Trust-Based Transformation

Trust-Based Transformation

Trust-Based Transformation

Closed-loop materials formulated for maximum recoverability and reuse

Cybersecurity for IoT devices and software

Seamless aggregation and sharing of manufacturing data

Least-cost, lightweight materials derived from waste

Manager of regional manufacturing networks that streamline distribution and withstand disruption

AI-driven, robot-equipped warehousing systems

Pagovision for Businesses

Terms & Conditions.

Privacy Policy

HIPAA

© 2025 Pagovision Inc

Powered by Pagovision

Powered by Pagovision